tax strategies for high income earners australia

Qualified Charitable Distributions QCD 4. Viajes baratos europa febrero 2019.

Pdf How To Achieve Tax Compliance By The Wealthy A Review Of The Literature And Agenda For Policy

Ad Enjoy low prices on earths biggest selection of books electronics home apparel more.

. As a refresher for 2021 FY the individual tax rates including medicare levy are. Avoiding the Medicare Levy Surcharge with Private Health Insurance. Jane earns 230000 salary per year and has 2 adult children of 19 and 18.

And when tax saving strategies for high income earners come into play you can put more money into your retirement plan and increase your tax deduction by opening a Solo 401k. 1441 Broadway 3rd Floor New York NY 10018. This is a tax-effective strategy because super contributions.

Tax strategies for high income earners australia. Dont discount the wealth-generating potential and flexibility an HSA can afford. What Is A High Income Family In Australia.

In australia the tax laws make it so that the highest earners of the country are taxed at unbelievably high rates. Pus belly button piercing. As a high-income earner you may feel comfortable about your ability to cover out-of-pocket medical costs.

Using a Discretionary Trust to reduce taxes. Based on the Australian Taxation Office 62000 taxpayers in the top 1 percent earned an average taxable income of 760853. Mon - Fri.

High Income earner in Australia have the most to gain from the financial rules and investment options if they have the right advice. Tax Planning Strategy 2. For taxable income levels between 180000 and 273000 the.

We will begin by looking at the tax laws applicable to high-income earners. That is why we suggest that you read our Ultimate Guide for the best tips to find the right financial advisor for you. Its possible that you could.

High-income earners make 170050 per year. So what are the top tax planning strategies for high income employees. Dont waste your good fortune or hard work by not.

Australians earning over 27k pay the Medicare Levy calculated at 2 of an individuals. How to Reduce Taxable Income. 6 Tax Strategies for High Net Worth Individuals.

Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super instead. The tax benefit of salary sacrifice super contributions is now more significant with the higher individual tax rates. Tax Planning Strategies for High-income Earners.

Browse discover thousands of brands. Read customer reviews find best sellers. Both are studying and will continue education for another 5.

Thats important to understand because you might assume that high-income earners are people making 400000 500000 or more each year. Family Income Splitting and Family Trusts. Tax reduction strategies for high income earners australia.

An overview of the tax rules for high-income earners. This is one of.

The Taxation Of Cryptocurrency Gains In Singapore Advanced American Tax

Roth 401 K In Plan Roth Conversions Morgan Stanley At Work

Pdf How To Achieve Tax Compliance By The Wealthy A Review Of The Literature And Agenda For Policy

Biden Would Raise Taxes Substantially For High Income Households But Cut Taxes For Families With Children Tpc Reports

An Agenda For Corporate Tax Reform In Canada Business Council Of Canada

2 Filling In The Gaps Expanding Social Protection In Colombia Oecd Economic Surveys Colombia 2022 Oecd Ilibrary

1 Key Policy Insights Oecd Economic Surveys Brazil 2020 Oecd Ilibrary

Why It Matters In Paying Taxes Doing Business World Bank Group

An Agenda For Corporate Tax Reform In Canada Business Council Of Canada

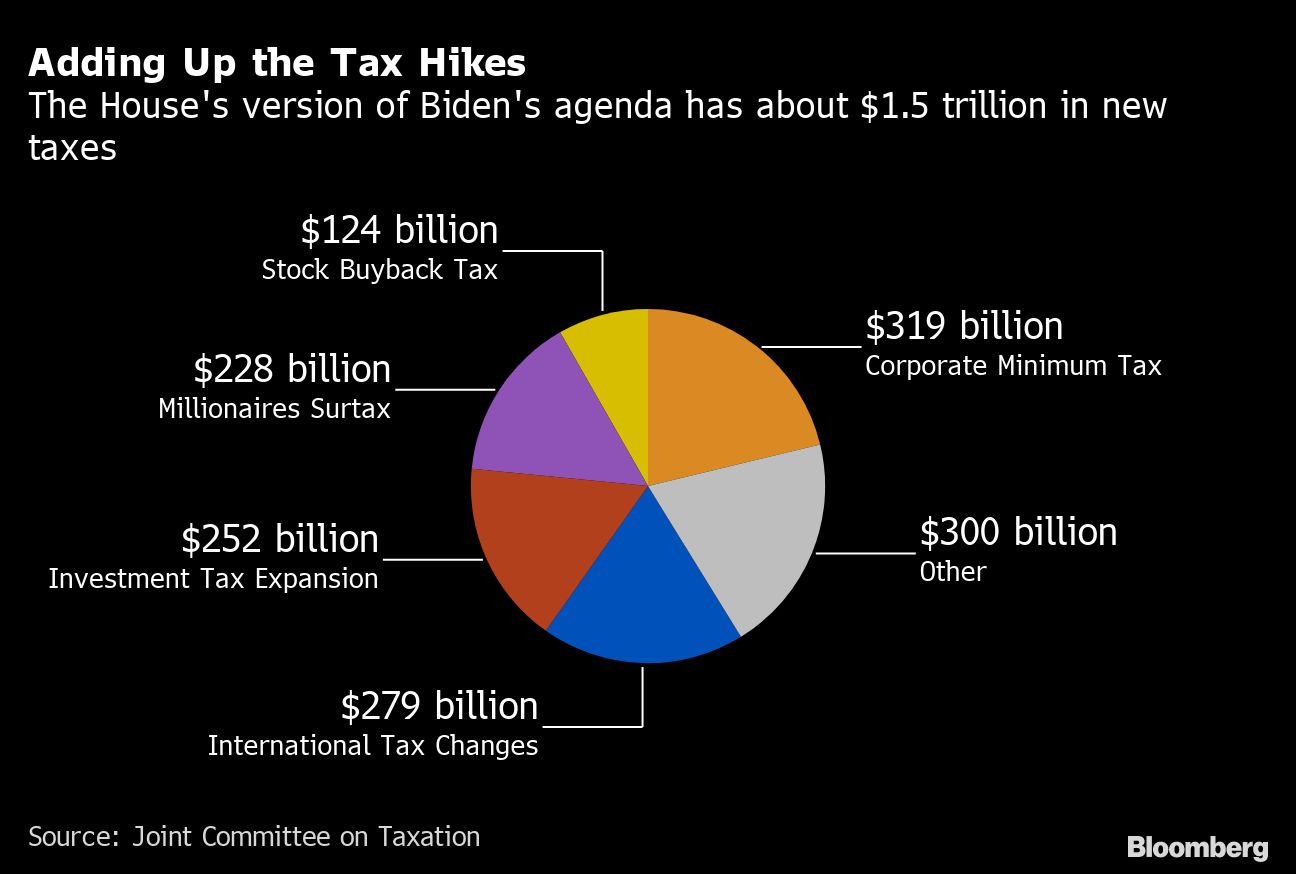

Rich Wall Streeters Face Shock Tax Hike While Rest Of Wealthy Escape Thinkadvisor

1 Key Policy Insights Oecd Economic Surveys Spain 2021 Oecd Ilibrary

10 Payroll Tax Fringe Benefits To Know Pherrus Financial Services

Wealthy Taxpayers Screaming About Lost Deductions Under Trump Tax Cuts

Australia Reaches Across Borders To Shore Up Post Pandemic Recovery Australian Institute Of International Affairs Australian Institute Of International Affairs

Tax Planning Strategies For Your 2021 Tax Return Wipfli

Career As A Tax Return Accountant Skills Required Tax Return Accounting Tax Accountant